On April 29, 2021 a lawsuit was filed against Jostein Eikeland who appears as a resident of Highland Beach, Florida (Civil Action No. 21-CV-80791). The plaintiff is Abalith Holdings Limited, a Cyprus Corporation, with a demand for $7,579,109.50 concerning the enforcement of a Final Arbitral Award, dated April 8, 2019 that was awarded in Geneva, Switzerland.

The basis for this award is a shareholders’ agreement entered into between the parties on February 19, 2016 and which was linked to an investment and shareholding in Alevo Group SA. The Agreement was entered into to refinance Alevo Group SA, and Abalith agreed to loan Jostein Eikeland $10,000,000 to be reimbursed to Abalith on or before July 1, 2018. A total of $7,500,000 was transferred to Eikeland, but the remaining $2,500,000 was never transferred because a certain milestone was never achieved.

More information is given in the adjoining exhibits to the Petition for Confirmation, Recognition, and Enforcement of Foreign Arbitral Award dated April 29, 2021 which make interesting reading for other shareholders of Alevo Group SA who were never informed of this shareholders’ agreement between Jostein Eikeland, Abalith Holdings Limited and Gingerpath Limited and their Reorganisation Agreement of December 5, 2016 regarding the reorganization of the shareholding and financing of Alevo Group SA. On the agreement Jostein Eikeland appears as residing in Verbier, Switzerland.

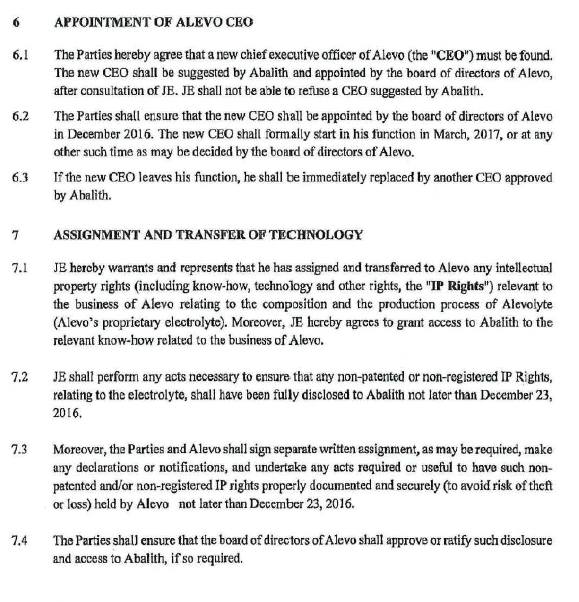

As part of this Shareholders’ Agreement all 4,366,666 Gingerpath Shares held by Jostein were transferred to Abalith, and it is stated that “all 3,219,206 Alevo Shares will have been validly transferred to Abalith and JE will not have voted (through his voting rights in Alevo held directly or indirectly) in a way to prevent such transfer” and a further condition was “the board of directors of Alevo will have appointed a new CEO”, or as stated in the agreement “the staffing of the function of the CEO of Alevo shall be regulated”. Furthermore, Gingerpath transfers to Abalith option rights to buy 250,000 Alevo Shares from Alevo at a strike price of CHF 80 per share and 650,000 warrants to subscribe Alevo shares at a price of CHF 120 per share.

Jostein was to raise an investment in Alevo Group SA in the amount of at least CHF 100,000,000 until 15 September 2017 through milestones which Jostein never met. So we can deduce from all this that Jostein was going to receive a $10,000,000 loan (of which he received $7,500,000) on the basis that he was going to raise CHF 100,000,000 for Alevo Group SA. In order to count towards the funds raised the shares could not be issued at less than CHF 28 per share.

The “Factual Background” provides references to Jostein promising to pay money with references from him such as “I’ll revert this week with Payment confirmation or schedule of payment” and then, in typical Jostein “you’ll get your money next week” Eikeland style, failing to meet those promises.

Maybe Jostein was so desperate to receive an immediate $5,000,000 from Abalith that he also made concessions on the IP to that party? The other shareholders were never made aware of this, and today Innolith, controlled by the same people behind Abalith, holds the IP. The board of directors seem to have dutifully complied without notifying other shareholders. At the same time Jostein was trying to raise new money from these shareholders, without disclosing the fact that Abalith was already entitled to have access to the IP and relevant know-how related to the business of Alevo (Sections 7.1 & 7.4, above)!

Did Chairman Eikeland and his Board then compromise the value of the company’s IP before the “Private Auction” of the IP in early 2018? If other parties know that Abalith already has a right to access the IP and the business know-how then Abalith would presumably be in a better position to bid for the IP and to put off other potential bidders?

In the Swiss Chambers’ Arbitration Case no 300436-2018 of April 8, 2019 Jostein Eikeland was represented by Thouvenin Rechtsanwälte, but not by Mr Markus Alder. Credibly defending Jostein under these circumstances must have been very difficult.

In the meantime Jostein finds himself in a tricky situation again. How’s he going to come up with over $7,500,000, or can he convince Abalith to hold off its claim? Or maybe he’ll find some other way of not paying?

Pingback: Jostein Eikeland - ALEVO STORY BLOG